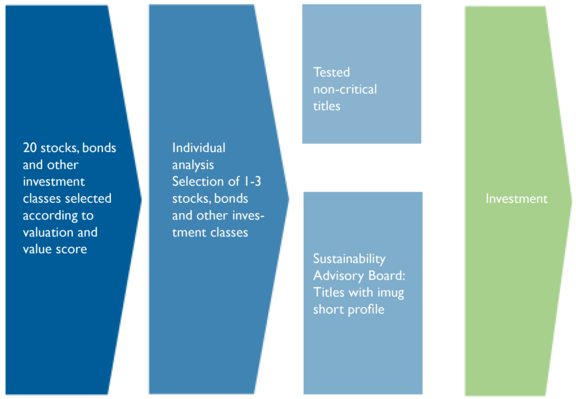

THE VALUE INVESTMENT PROCESS

The portfolio managers for the ACATIS Fair Value funds look for securities whose intrinsic value is higher than the market capitalisation, that include a margin of safety and that promise positive price developments in the future. That is our value investment process.

All ACATIS Fair Value funds are managed by the portfolio management team led by Dr. Hendrik Leber. In 2017, Dr. Leber was elected “Fund Manager of the Year”, and he was also awarded the Golden Bull.

Stocks

In the case of stocks, the portfolio manager diversifies by industry and country/regions. A number of stand-alone issues are also defined as an investment class.

Bonds

Portfolio management mainly invests in euro bonds (specifically, corporate bonds). In addition to government bonds, we also define supranational issuers (e.g. European Investment Bank), quasi-sovereign issuers (e.g. KfW or Deutsche Bahn), local entities (e.g. city of Warsaw), covered bonds, convertible bonds, inflation-protected bonds or emerging markets as separate investment classes.

Other investment classes

The block of “other investment classes” consists of real estate, forestry and other innovative investment instruments (e.g. volatility certificates) or hedging instruments. The portfolio manager uses these instruments to stabilise the fund against fluctuations and to take advantage of market opportunities in undervalued asset classes.